This week, the House of Representatives will try to pass their Reconciliation legislation, which Trump insists on calling One Big Beautiful Bill. A bill considered through reconciliation is supposed to only focus on budgetary matters. One to two of these are allowed per session. In a reconciliation bill, a simply majority is all that is required to pass, avoiding the possibility of a Senate filibuster.

It is used when one party has a majority in both houses of Congress but lacks the margin to pass a cloture motion stopping a filibuster. It has been used by both parties. The final Affordable Care Act (Obamacare) bill passed through reconciliation (after Ted Kennedy died). The 2017 Trump tax cuts passed through reconciliation. So did the Biden Inflation Reduction Act.

Reconciliation bills theoretically pay attention to the Byrd rule, which examines the impact of the legislation over a ten year period to make sure it doesn’t increase the deficit by too much. However, this is usually accomplished by using certain time horizons supported by accounting tricks. The reason President Trump and the Republicans are eager to extend the 2017 tax cuts is that they face a sunset clause that will be politically disastrous. The reason they had a sunset clause was to fit reconciliation rules. The same thing happened with the Bush era tax cuts. The gamble was that Congress would have to extend the tax cuts so as not to hit their constituents with later tax increases.

So how do you make reconciliation work? You identify offsets, things where the government can claim to spend less over the ten year period, thereby permitting the tax cuts.

This gets harder and harder to do. As the DOGE boys learned, there isn’t nearly as much fat in the budget as they assumed and frequently cut to bone before having to back down. And since they don’t want to address Defense spending, and want to spend more on Homeland Security, they have to cut deeply into other areas.

So, how does the One Big Beautiful Bill (OBBB) propose to cut taxes? They propose to cut spending on Medicaid, SNAP (food stamps), and the climate initiatives in the Biden Inflation Reduction Act. Both the New York Times and Vox have excellent explainers about what’s involved.

There are a couple of ideas for squeezing money out of Medicaid: the health care program for lower income folks, children, the disabled, and elderly in assisted living. Their big idea is to add work requirements for those applying for Medicaid. Able bodied adults will have to demonstrate that they are working 80 hours a month and will have to submit that paperwork twice a year. Any errors in paperwork or processing would result in someone being dropped from the program. States that use their own budgets to support health care for immigrants will have their federal amount lessened. Reduced support for smaller rural hospitals will require people to travel further for health care.

The legislation hit a roadblock on Friday when four Republican members of the House Budget Committee voted against moving the bill forward. Their reason? It didn’t do enough harm fast enough. The proposal delayed the work requirements until 2029 so that public outcry would fall on the next administration. The holdouts wanted the work requirements to kick in on passage. Yesterday, the four voted “present” to allow the legislation to move forward out of the Budget Committee while they continued their fight.

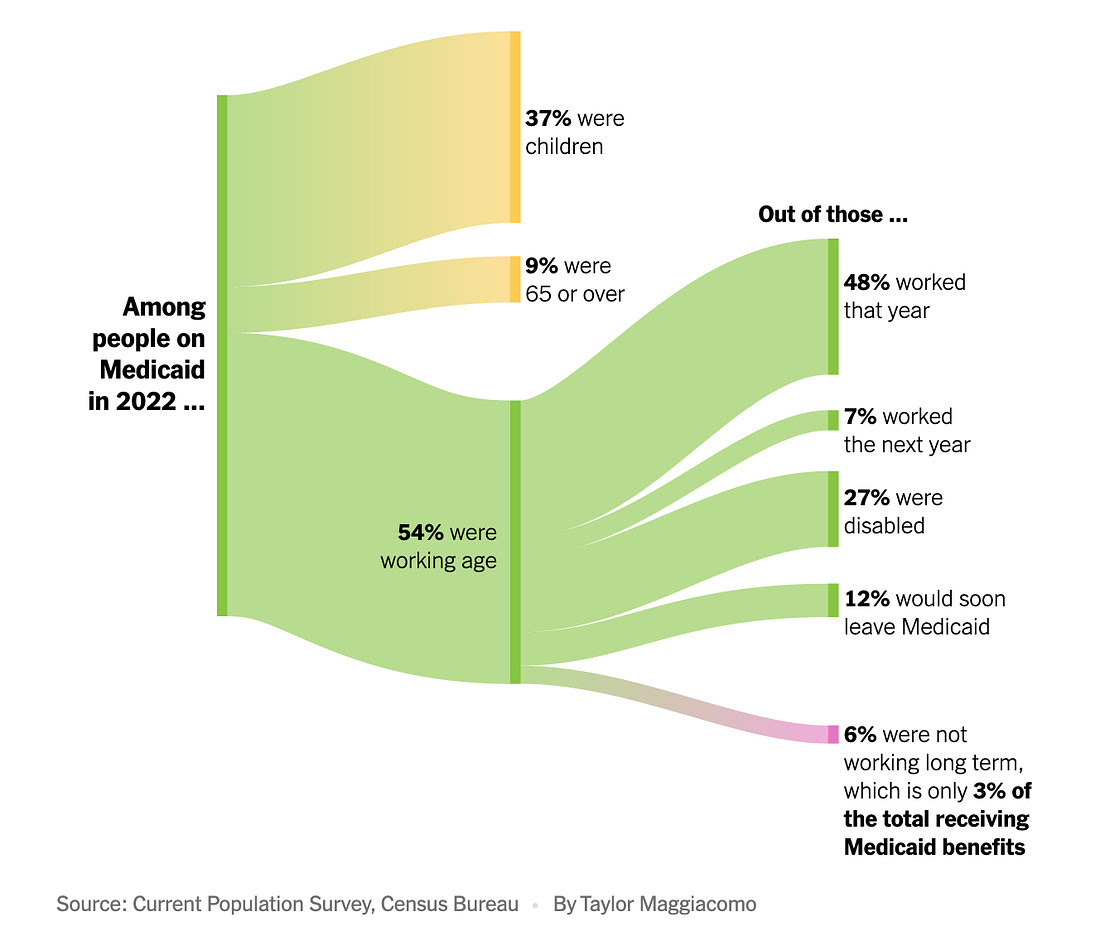

There are serious problems with what the Republicans are proposing. First of all, their work requirements are unlikely to have the impact they propose. In his SubStack today, Paul Krugman shared this chart that Matt Bruenig had used in a piece in the Times.

The proposal does raise the top age of being “able-bodied” from 54 to 64. Even still, the work requirement would only impact about 13% of recipients (the 7% plus the 6%). I’m pretty sure that when Speaker Johnson talks about “able-bodied men sitting at home playing video games” he’s imagining a figure much higher than 13%.

The big savings are likely to come from denying initial Medicare claims or revoking existing claims and/or from cutting funding to the states or adding/increasing co-pays for medical care. The natural result of these draconian measures over the coming years is fewer people seeking medical care until their situations are more acute.

The proposed cuts in the SNAP program will result in families eating less well. For an administration that has decided that the goal of RFK Jr.’s HHS is to advocate for healthy lifestyles as the way to cut healthcare costs, this seems outrageous. Unless, of course, they think that poor people are not really deserving of these supports. Paul Waldman put it well last week:

Work requirements are terrible policy, but what matters is why Republicans want to use them to kick all those people off their insurance. It’s because they hate people who need Medicaid. The same goes for those who might need food stamps or student loans, workers who want to bargain collectively, and pretty much anyone who isn’t lucky enough to be rich. They hate you.

If you doubt, look at this execrable op-ed in the New York Times from a quartet of Trump officials including Robert F. Kennedy Jr. explaining why work requirements are necessary because of the fundamental laziness of the American people. While we ordinarily use the term “welfare” to refer to cash payments — especially the TANF program, which has been whittled down so far that it barely exists anymore — the Trump goons no doubt understand that people tend to associate the word “welfare” with black people and black women in particular, which is why they repeat the word no fewer than 18 times in the op-ed to refer to Medicaid.

The purpose is to argue that Medicaid recipients are a bunch of contemptible malingerers, and rather than a fundamental human right, health insurance is something that should be granted to people of modest means only if they can prove that they are morally worthy of going to the doctor when they get sick. “For able-bodied adults, welfare should be a short-term hand-up, not a lifetime handout,” they write. “We believe that work is transformative for the individual who moves from welfare to employment.” So get off the couch, you loser, and if you can show you have transformed yourself into something less pathetic — and don’t ever make a mistake on all the forms we’re going to make you fill out — then maybe we’ll consider letting you have coverage.

Consider the fact that nobody is proposing putting conditions on the benefits that will flow to the upper classes or to corporations. They are somehow inherently deserving of the support from the government in the shape of tax cuts. The theory is, as it has been since Reagan, that they will make sizable returns on those investments. In reality, they will likely engage in more stock buy backs and buy another yacht.

Krugman also shared a chart from the Tax Policy Center showing how much worse the OBBB is than the 2017 TCJA. Where the 2017 version resulted in small tax benefits for all Americans with huge benefits for the upper class, the new version is simply draconian when we combine tax proposals with the safety net cuts.

Cutting the Biden era Clean Energy proposals is partisan payback. But it will have significant impact on those workers who are working in those startup plants, auto plants, or renewable energy installations. And because Biden was trying to boost employment in “red states”, that’s where the hit will be. That’s on top of the decimation faced by thousands of government employees over the last four months.

Not only will the lower classes have less money after taxes if OBBB passes, they will be disproportionately hit by Trump’s tariff agenda The top .1% don’t spend a lot of time shopping at Walmart, so they won’t feel the impact if Walmart passes along their costs to consumers. The bottom 20%, on the other hand, definitely will.

So this One Bill is really trying to pursue many initiatives at the same time, loosely bundled together as a financial bill. Because to really accomplish long-lasting policy changes that last beyond the current administration requires the kind of give-and-take legislation that can achieve 60 votes in the Senate.

And it’s not Beautiful. Especially if you aren’t someone in the upper tiers of the economy who likes to gold-plate fixtures and who looks our for a “palace it the sky” mode of transportation.

We need to make clear to our representatives that this is not okay. They think that we’ll simply go along with whatever the administration wants because we lack the votes to stop them in Congress.

This morning, Press Secretary Karoline Leavett gave her spin on OBBB.

“The ‘America First’ policies in this bill are the reason why Republicans currently have the majority in Congress right now,” Leavitt said. “Passing this bill is what voters sent Republicans to Washington to accomplish. And that’s why it’s essential that every Republican in the House and the Senate unites behind President Trump and passes this popular and essential legislative package.”

Not surprisingly, her claims here are way off base. The state of the economy was the primary factor in the 2024 election, along with Biden’s age and inaction regarding the devastation in Gaza. This is not what people asked for, especially those working and lower class voters who supported Trump and Republicans to see their financial well-being improve.

Once again, their concerns are seen as salient until after the election is over. Then the priorities can return to improving the lives of the well-off at the expense of those who struggle.

BIG BEAUTIFUL BILL = FISCAL GENOCIDE