[I said in my last newsletter that I would be shifting my focus from the college group to those Will Bunch defined as Left Behind or Left Out. In light of the Biden administration’s announcement on college debt relief, I’m holding off on that until next week.]

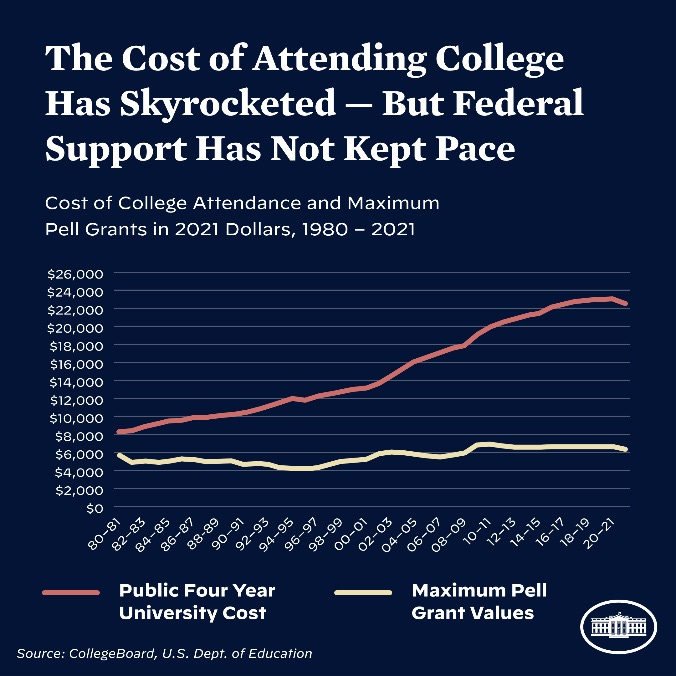

So the long anticipated Biden administration announcement on college debt happened today. Reading through the White House Fact Sheet, I can understand why it took so long to get here. This is a carefully crafted plan that deals with a number of different factors at the same time. In setting context for the plan, the Fact Sheet opens with the following chart:

In constant 2021 dollars (meaning inflation is controlled), Pell grants for low income populations have remained virtually flat over the last 40 years while the cost of college nearly tripled. One critical driver of the cost escalation, especially at public institutions, is the conscious disinvestment in higher education by the states. There are other cost-drivers to be sure (more below) but that one is significant. The federal government continued to support students pursuing higher education (often through loans) but failed to keep up with the changes happening in higher education.

There has been significant reporting in recent years about the economic impact of the high college debt load held by individuals, ranging from being able to afford housing (too many stories about graduates living in parents’ basements), saving for retirement, getting married, having children, taking job risks, and the like. Too many students were victimized by for-profit “career” institutions that loaded them with easy debt but failed to produce promised jobs.1 There’s also the problem of students who didn’t finish college after buying the argument that college would bring earnings but now only face debt with nothing to show for it.

In reading through the proposal, I was reminded of an approach to policy formation I heard sociologist Theda Skocpol advocate 35 years ago. She called it “targeting within universalism”. This approach argues that we can address specific social problems by embedding certain targets within broadly applicable social programs. I can’t say that the Biden folks read Skocpol, but their approach is a great example of what she argued for.

So what’s in the plan?

First, the near-universal part. Up to $10,000 in loan forgiveness for any individual earning less than $125,000 annually ($250,000 for couple — I’m assuming that a two college couple gets $10K each). There is a change for those in an income repayment program from being expected to pay 10% of their discretionary income down to 5% of discretionary income. Faithful debtors who pay regularly on their loans will receive full forgiveness in 10 years instead of the current 20.

The targeting part comes in with the additional support for Pell Grant recipients. For those former students, the amount of debt forgiveness doubles to $20,000. In addition, parent oriented PLUS loans qualify for forgiveness (up to the $20K per student named).

All of this is accompanied by continuation of the Covid era pause in repayments that will now expire at the end of 2022.

Could more have been done, as progressive keep asking? Sure. But until we have a shift in college financing toward free community college or nearly free public education, that’s not likely.2 But if the average debt for a bachelor's degree is $32,8803, $10,000 to $20,000 in loan forgiveness will have a big impact.

Isn’t this simply cost shifting?

Critics argue that forgiving loans for college students is unfair to those who paid off their loans already or who never went to college.4 At some level, that is true. But we have a long history of subsidizing parts of the population in service of some greater good, even though it’s unfair to some. Consider the GI Bill, which was such a boon to college enrollment and programmatic growth. If you didn’t serve, were female, or were Black, you didn’t get the benefit. But the government saw a broader public good in terms of soldiers returning from War.

Also, some of the likely critics of college debt relief were supportive on the PPP payments (and loan forgiveness) that went to businesses during Covid (some of which had no need for the funds or who engaged in outright fraud). We took a similar tactic to support the auto industry during the Great Recession. We supported the Big Banks in TARP.

By the way, these same critics who will argue against the proposal are currently demagoguing the IRA provision that supports IRS enforcement against tax cheats by claiming that 87,000 jackbooted thugs are coming to take your guns.

Here’s another way to think about the federal government’s role in this. The chart above shows that the government failed to care for lower-income populations pursuing the college degrees everyone said they needed. If the Pell Grant levels had kept up with college costs5 we wouldn’t be in this situation. After Katrina hit New Orleans in 2005, federal and state governments paid out $120 Billion in relief, in part because the Army Corps of Engineers bore some responsibility for the failure of the levees, which did little to nothing for people not living in New Orleans. Because local police departments have qualified immunity, civil payments to those injured or killed by police actions are paid out of city budgets (or through the insurance premiums those city's carry). Those payments are part of the city budget paid by the residents.

What about moral hazard?

Doesn’t a program like this mean that current and future students will be incentivized to take out large loans for college and then either default or beg the government for another bailout? Perhaps. But there are ways of building better safeguards into loan programs going forward. Limiting (or at least exposing) bad actors will go a long way in making this a smoother transaction. Admissions officers and Financial Aid representative must show more diligence toward the long term debt impact rather than “making things work”, which is too often needed to get the student enrolled.

But we need to fix the cost of college

Yes, we do. But that’s a longer term project that will require significant policy reformation at the state and national level. As Will Bunch’s book points out, as long as higher education is not seen as a public good and instead simply an individual consumer choice, it’s going to be tough to do.

Besides, even setting aside the climbing walls and lazy rivers, real expenses do accrue in higher education. Health Care costs and Utilities are chief among them. As long as we aren’t dealing with these issues on a national scale, universities will have to absorb those costs. They will do so by cutting programs and faculty or by passing those increased expenses on to students.

It will help to continue the College Scorecard, which identified true costs after scholarships, money earned post-graduation, and default rates. It’s not clear that students and families are using that information effectively, but there are steps we can take to isolate bad actors (both for-profit and non-profit).

Can Biden do this?

There will no doubt be court cases challenging the president’s executive order, likely from the same suspects. The legal predicate for the action has been developed, drawing upon the broad authority to respond to Covid disruptions. Of course, there is nothing stopping Congress for dealing with the College Debt crisis except that Republicans don’t want to.

All in all, this looks like a responsible proposal that splits the proverbial baby between those who want to forgive all student debt and those who want to forgive none. The focus on Pell Recipients make this a perfect example of targeting within universalism and has a better than even chance of having the desired economic impact.

Last week, the Department of Education vacated all loans accrued through the now-defunct ITT Tech, same as happened with Corinthian College students in the Trump adminstration. Also, the DOE removed the Title IV eligibility of one of the most egregious for-profit accrediting bodies.

These proposals are the best way to return higher education to a public good and control cost spirals but will be devastating to private institutions.

There are always news reports of someone who owes $100K or more in college loans but such students are always outliers. They make dramatic copy but don’t reflect the experience of most students.

Government supported 529 programs allow upper middle class families to set aside tax-free money toward a child’s future education, something that is theoretically possible for lower income families but practically impossible.

Yes, you could argue that the same could happen if college costs only grew as fast as Pell Awards, but that’s a much more complicated fix.

Thank you for this insightful analysis of the student loan forgiveness issue. I much appreciate it.

I find it odd that the political folks who applauded forgiveness for businesses and tax cuts for wealthy folks and corporations would oppose this. I think I know why...

Another thing--the minimum wage should've been indexed to inflation back in the day. That too would likely have been transformative.

Money is something of a social contract, it's an invention of a society. When the rules by which money operates are flawed, responsible government will step in.

Thanks again!